The Vietnamese pickup truck market witnessed an alarming drop in sales at the beginning of 2018, a complete reversal from the strong growth of 2017. According to a report from the Vietnam Automobile Manufacturers Association (VAMA), pickup truck sales in February and the first two months of 2018 decreased by 59% compared to the previous month and 23% compared to the same period in 2017. So, what caused the pickup truck market, previously favored for its tax and fee advantages, to fall into such a dismal state? The answer lies in the 2018 pickup truck tax policy, specifically the proposed adjustments to the special consumption tax (SCT) and registration fees.

Pickup Truck Sales “Freefall” in Early 2018

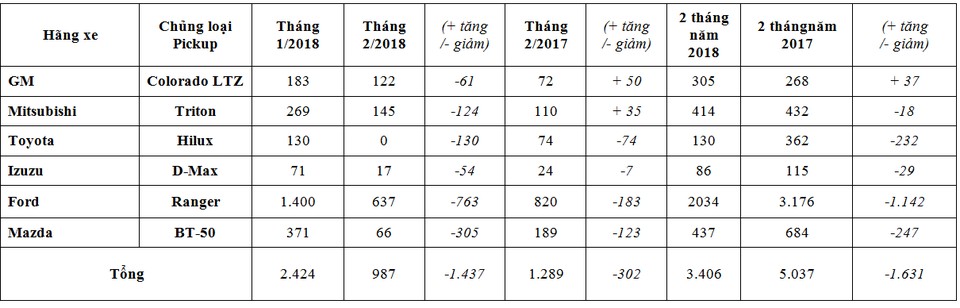

VAMA’s data reveals that the sales decline was widespread, affecting most pickup truck brands present in the Vietnamese market. Major players such as Ford Vietnam, Toyota Vietnam, and Truong Hai (Thaco) all recorded significant decreases. Some automakers even experienced a near “freeze” in pickup truck sales in February 2018.

Sales chart showing sharp decline in pickup truck sales in Feb 2018 due to 2018 tax policy

Sales chart showing sharp decline in pickup truck sales in Feb 2018 due to 2018 tax policy

Specifically, Toyota sold no pickup trucks in February 2018. Isuzu sold 17 D-Max units, a decrease of more than 50 units compared to the previous month. Ford Ranger, the best-selling pickup truck in the market, also saw sales decline by nearly 800 units, down to just over 630 vehicles. Mazda BT-50 from Truong Hai also faced the same situation, with sales down nearly 300 units compared to the previous month, selling only 66 vehicles. Compared to the same period in 2017, the decline is even more concerning, especially for Ford Ranger (down more than 1,140 units), Mazda, and Toyota.

The “Ghost” of 2018 Pickup Truck Tax: The Main Cause of the Decline

The underlying cause of this decline stems from information about the Ministry of Finance’s proposal to increase taxes and fees on pickup trucks. This proposal included increasing the SCT on pickup trucks to 60% of the SCT on passenger cars with the same engine displacement, and increasing registration fees to 10% or 12% instead of the previous 2%.

If this proposal was approved and the 2018 pickup truck tax was applied in an upward direction, the SCT rate for pickup trucks with engine displacements from 2.0L to over 3.2L would range from 30% to 54% depending on the displacement and the time of taxation. Registration fees also increased significantly, creating significant pressure on vehicle prices.

Decree 116 and the “Wait-and-See” Sentiment in the Pickup Truck Tax Market

2017 witnessed a boom in pickup truck sales thanks to import tax advantages from Thailand and more favorable SCT and registration fees compared to passenger cars. However, from the second half of 2017, as information about the proposed changes to the 2018 pickup truck tax began to spread, the market showed signs of stagnation.

Although Decree 116, issued in October 2017, did not directly adjust pickup truck taxes, it impacted the sentiment of automobile importers in general and pickup truck importers in particular. Hesitation and concern about policy risks led businesses to reduce imports, resulting in a gradual decrease in the number of pickup trucks on the market and a sharp drop in sales in early 2018.

0% Import Tax Fails to “Rescue” Sales

In reality, the reduction of import tax on passenger cars from ASEAN (including Thailand and Indonesia, the main sources of pickup trucks for Vietnam) did not bring much benefit to pickup trucks in the context of 2018. The import tax on pickup trucks was already low (5% in 2017), and the reduction to 0% only helped reduce import costs by a small amount.

The biggest concern for businesses and consumers was the adjustment of SCT and registration fees. If these changes were approved, pickup truck prices could increase by hundreds of millions of Vietnamese Dong, creating a major “shock” to the market and causing sales to continue to plummet.

Nguyen Tuyen